Personal fairness corporations invested almost $70 billion in the lifestyle sciences and healthcare system industries final calendar year — a signal that the pandemic’s disruptions didn’t cool desire in the sectors, in accordance to a new report by the American Investment decision Council.

Why it issues: The influx of funds could support convey a lot more lifesaving drugs and health care systems to market. But private equity’s developing presence in health and fitness care is not normally seen positively, specifically when it is really connected with selling price increases or lessened accessibility to treatment.

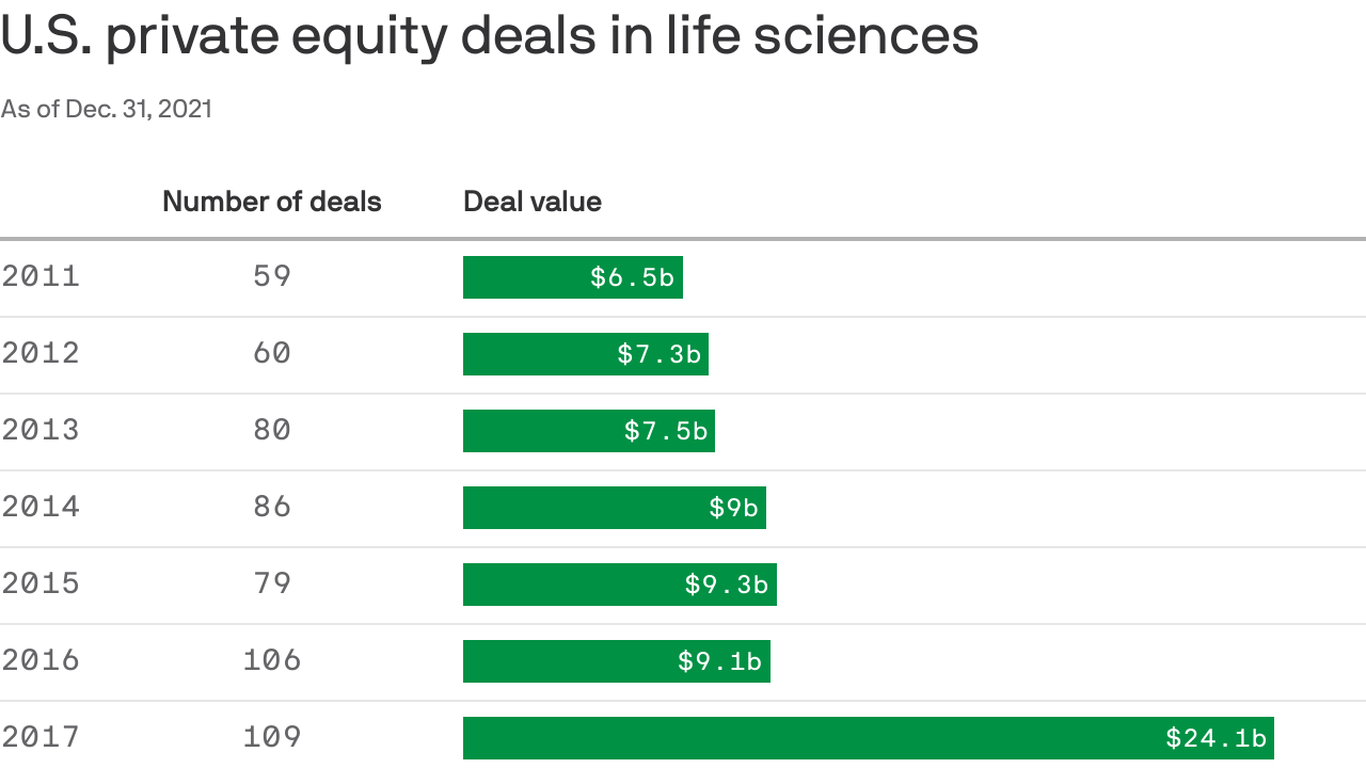

By the figures: Personal fairness discounts in the life sciences sector had been value practically $26 billion in 2021, the best sum in a decade.

- Professional medical products and supplies discounts have been worthy of nearly $44 billion previous yr, which was also the optimum value above the previous ten years — by much.

- Personal equity has invested more than $280 billion into the sectors above the very last 10 years, in accordance to the report.

What they are indicating: “What COVID brought was probably a bigger concentrate on wellness treatment gaps and demands in the state, and I assume you observed additional income likely into this sector as a final result of a new concentrate on exposing some of the worries we have in the health treatment process,” American Investment decision Council CEO Drew Maloney reported in an job interview.

- “We actually are filling a hole in the market to provide these innovations to life as a result of our funding mechanisms,” he additional.

The huge picture: Private fairness firms like Bain Capital, Cerberus and Blackstone Group by now have invested heavily in hospitals, nursing residences and staffing providers — which not everyone thinks is a great detail. The corporations typically count on debt financing to buy belongings, increase returns to associates and exit in a quite shorter window of time.

- The presence arrived into participate in in the course of Washington’s surprise billing debate, which targeted partly on the habits of non-public fairness-backed doctor staffing corporations. Personal equity-owned nursing households have also been criticized as giving decrease-high-quality treatment.

Yes, but: Investing in drug and gadget enhancement isn’t really the exact same as investing in these other locations, mentioned Craig Garthwaite, a professor at Northwestern University’s Kellogg School of Administration.

- “There’s plenty of price to be developed and captured by these private fairness firms, and there is substantially significantly less of the fret … about personal fairness and well being treatment companies or suppliers,” Garthwaite claimed. “In a solution sector, we consider of this becoming the area of for-revenue companies, and we are just arguing about what the capital construction is.”

- And for personal fairness to lead to greater drug prices, pharmaceutical providers would have to not previously be charging the best charges that the current market will bear.

- “I do not assume it’ll increase selling prices here, because I feel people today will demand regardless of what they can for the solution, and if they slice prices they’re going to just just take it as earnings,” Garthwaite included.

More Stories

5 Simple Ways to Protect Your Vision Amid Heatwave

The Kids Are Home from School: 4 Tips to Address Youth Mental Health

Skin Care During Hot Weather | Dermatologist-recommended skin care tips during this heatwave